The pros and cons of buying a property in a development

Newcastle and the surrounding areas have been undergoing a lot of regeneration over the past few years, and there are many great housing developments still in the pipeline. If you’re thinking of a change of scene and/or lifestyle, many of these new developments offer some great opportunities. However, there are other factors you may want.

How to choose a good removal company

Moving home is high up the list of life’s most stressful experiences. As well as the long list of jobs to do, documents to sign and people to organise, there is often an emotional aspect too, particularly if you’ve been living in the property for several years. From the valuable, and fragile to the heavy.

What to do with property when the unexpected happens

Life is what happens when you’re busy making other plans according to the American writer Allen Saunders – and life events have a habit of happening when you least expect it. With people living longer and the increase in ‘blended’ families through people remarrying, financial and family arrangements can be a complex web. And when.

5 essential research steps for your next investment property

Investing in property is a big financial commitment, so you do need to do your research before jumping in. The internet has made making research a lot easier, but the key to good research, is knowing what to look for, and once you’ve got the information, knowing how to analyse real estate market data. This.

What to budget for when selling your home

From marketing expenses and contract preparation to renovations to add value, there’s lots to consider when selling your home. Here are some of the main ones to consider: Legal costs When selling a property, you do really want to ensure all the paperwork is in order. The main legal requirements include: Contract preparation Prepared by.

Newcastle house prices still higher than a year ago

Welcome to 2023! Last year saw a rapidly rising serious peak in the property market and while interest rates and economic factors are now playing a major role in property prices in the short term, let’s take a critical look at what the data is saying. Data has long played a role in property, and.

Newcastle and Lake Macquarie house price rate of decline eases

The latest report from CoreLogic is the Christmas news we’ve been waiting for; according to the data specialist’s latest Home Value Index the fall in house values has begun to ease in our region. CoreLogic’s research director, Tim Lawless, said the easing in the rate of decline is mostly emanating from the Sydney and Melbourne.

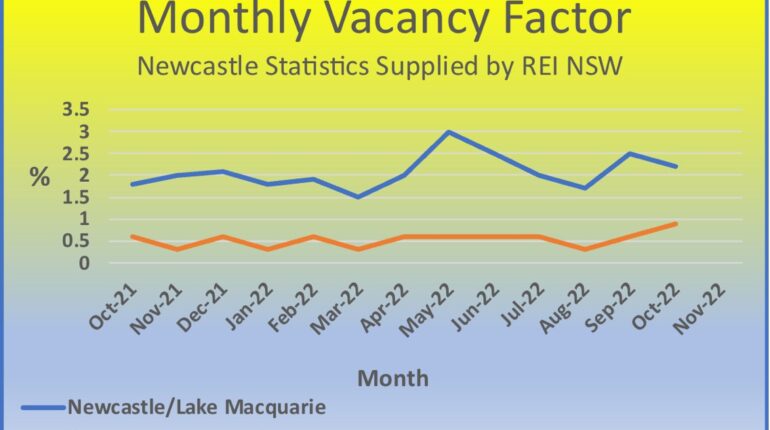

Vacancy rates in Newcastle and Lake Macquarie

The CoreLogic home value report shows while housing is taking a relative downfall, rental value growth actually remains high across Australia; the report suggest regional rents are up 25.5%., and indeed, we have seen rents increase over the past few months, although not by this much. What this means is, as rents continue to rise.